In our country, foreign-plated vehicles passing through toll roads and bridges that require payment must become subscribers to the HGS (Fast Pass System) maintain a balance in their HGS accounts that covers at least the toll fee to avoid being penalized. HGS accounts can be opened at PTT branches and agencies at customs gates and within the country, as well as at bank branches. Detailed information about HGS can be accessed at (hgsmusteri.ptt.gov.tr) website.

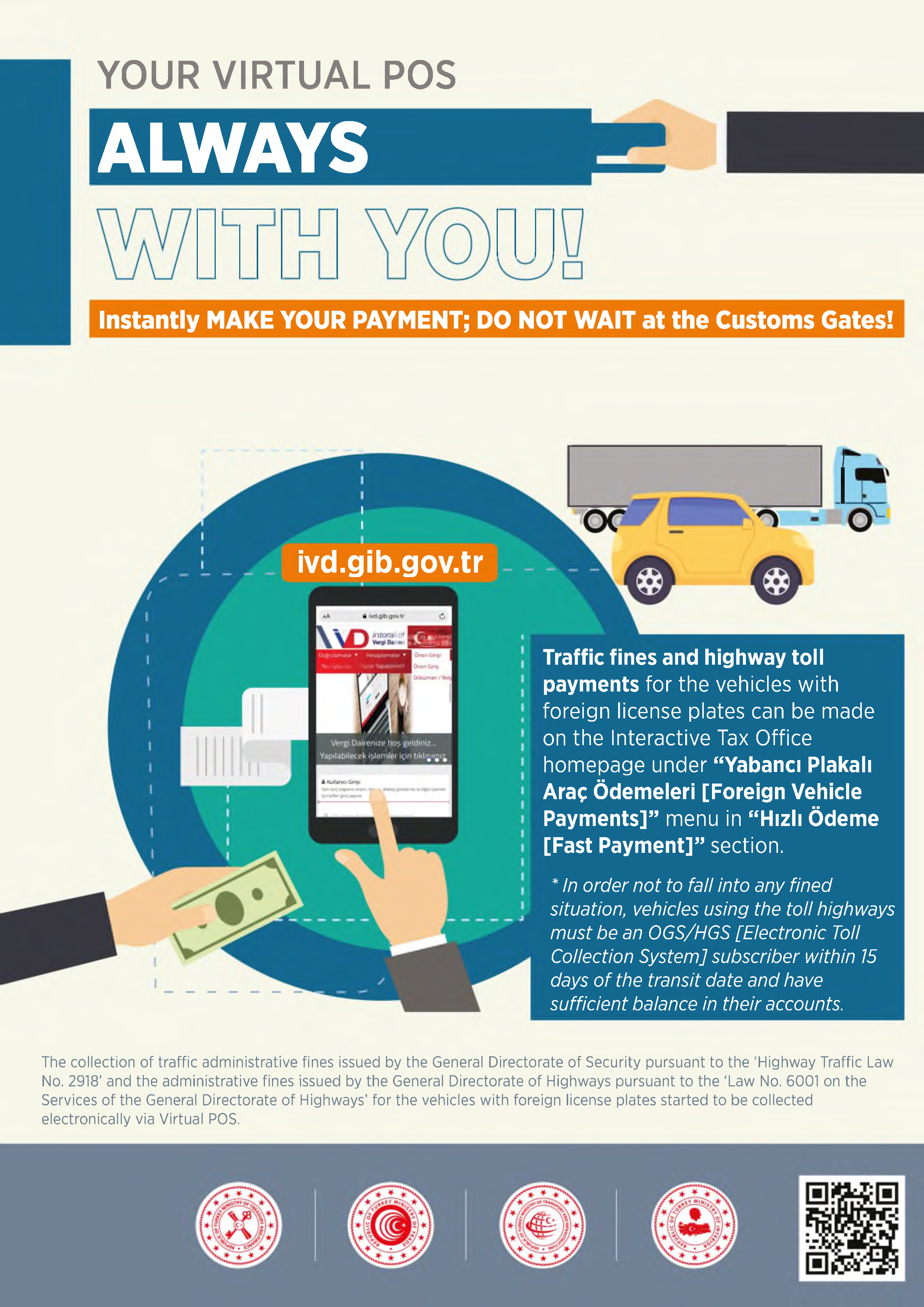

To prevent the owners of vehicles without an HGS account or with insufficient balance in their HGS accounts from being penalized for unauthorized passage through toll roads and bridges operated by the General Directorate of Highways, they must either open an HGS account within 15 days from the date of the unauthorized passage, load sufficient balance onto their HGS accounts to cover at least the toll fee, or make payments for toll fees for foreign-plated vehicles through the "Foreign-Plated Vehicle Payments" menu under the "Quick Payment" section on the main page of the Interactive Tax Office (ivd.gib.gov.tr) or through the " Pass Violation Querry and Payment" page on the main page of the General Directorate of Highways (www.kgm.gov.tr). Otherwise, these vehicles will not be allowed to leave the country through customs gates without paying the toll fees within 15 days from the date of the unauthorized passage.

Furthermore, the owners of foreign-plated vehicles who fail to pay toll fees within 15 days from the date of unauthorized passage must also pay the toll fees and administrative fines through the "Foreign-Plated Vehicle Payments" menu under the "Quick Payment" section on the main page of the Interactive Tax Office (ivd.gib.gov.tr) or through the "Pass Violation Querry and Payment" page on the main page of the General Directorate of Highways (www.kgm.gov.tr). Otherwise, these vehicles will not be allowed to leave the country through customs gates without paying the toll fees and administrative fines.

To prevent foreign-plated vehicles from queuing and causing congestion at customs gates, they must pay toll fees and administrative fines through the Interactive Tax Office or the General Directorate of Highways website as described above before arriving at the customs gates.